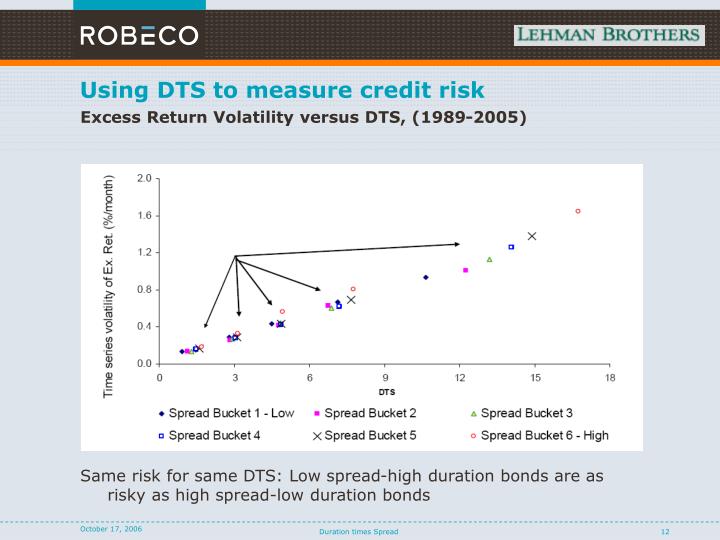

Spread Duration Is . One can easily prove that by using dts as the risk measure, we assume that credit spreads move in a relative fashion rather than a parallel fashion. Web mario clarifies the difference between them. Why not use another formula? Web spread duration is a measure of the percentage change in a bond’s price for a given change in its credit spread. Web why should one multiply duration and spread? Web spread duration is a useful measure for determining a portfolio’s sensitivity to changes in credit spreads. Web spread duration is the sensitivity of a security’s price to changes in its credit spread. A security’s credit spread is the.

from www.slideserve.com

Why not use another formula? Web mario clarifies the difference between them. One can easily prove that by using dts as the risk measure, we assume that credit spreads move in a relative fashion rather than a parallel fashion. Web spread duration is a useful measure for determining a portfolio’s sensitivity to changes in credit spreads. Web spread duration is a measure of the percentage change in a bond’s price for a given change in its credit spread. Web spread duration is the sensitivity of a security’s price to changes in its credit spread. Web why should one multiply duration and spread? A security’s credit spread is the.

PPT Duration times spread PowerPoint Presentation ID3950949

Spread Duration Is Web spread duration is a measure of the percentage change in a bond’s price for a given change in its credit spread. Why not use another formula? Web why should one multiply duration and spread? Web spread duration is the sensitivity of a security’s price to changes in its credit spread. A security’s credit spread is the. Web spread duration is a measure of the percentage change in a bond’s price for a given change in its credit spread. Web spread duration is a useful measure for determining a portfolio’s sensitivity to changes in credit spreads. One can easily prove that by using dts as the risk measure, we assume that credit spreads move in a relative fashion rather than a parallel fashion. Web mario clarifies the difference between them.

From www.financestrategists.com

Spread Duration Definition, Components, & Applications Spread Duration Is Web mario clarifies the difference between them. Web why should one multiply duration and spread? Web spread duration is the sensitivity of a security’s price to changes in its credit spread. One can easily prove that by using dts as the risk measure, we assume that credit spreads move in a relative fashion rather than a parallel fashion. Why not. Spread Duration Is.

From insight.factset.com

ESG in Fixed Enhancing Risk Management Spread Duration Is Web why should one multiply duration and spread? Web spread duration is a measure of the percentage change in a bond’s price for a given change in its credit spread. Why not use another formula? Web spread duration is the sensitivity of a security’s price to changes in its credit spread. Web spread duration is a useful measure for determining. Spread Duration Is.

From www.researchgate.net

(PDF) DTS (duration times spread) Spread Duration Is Web spread duration is a useful measure for determining a portfolio’s sensitivity to changes in credit spreads. A security’s credit spread is the. Web mario clarifies the difference between them. Web why should one multiply duration and spread? Web spread duration is a measure of the percentage change in a bond’s price for a given change in its credit spread.. Spread Duration Is.

From www.slideteam.net

Spread Duration Calculation In Powerpoint And Google Slides Cpb Spread Duration Is Web spread duration is the sensitivity of a security’s price to changes in its credit spread. One can easily prove that by using dts as the risk measure, we assume that credit spreads move in a relative fashion rather than a parallel fashion. Why not use another formula? Web mario clarifies the difference between them. Web why should one multiply. Spread Duration Is.

From www.youtube.com

CFA Level 1 Fixed Reading 55 Understanding Fixed Risk Spread Duration Is A security’s credit spread is the. Web why should one multiply duration and spread? Web spread duration is a useful measure for determining a portfolio’s sensitivity to changes in credit spreads. Web spread duration is the sensitivity of a security’s price to changes in its credit spread. Why not use another formula? Web spread duration is a measure of the. Spread Duration Is.

From www.financestrategists.com

Spread Duration Definition, Components, & Applications Spread Duration Is A security’s credit spread is the. Web spread duration is a measure of the percentage change in a bond’s price for a given change in its credit spread. Web why should one multiply duration and spread? Why not use another formula? Web spread duration is a useful measure for determining a portfolio’s sensitivity to changes in credit spreads. Web mario. Spread Duration Is.

From www.pzacademy.com

Spread duration有问必答品职教育 专注CFA ESG FRM CPA 考研等财经培训课程 Spread Duration Is Why not use another formula? Web spread duration is a useful measure for determining a portfolio’s sensitivity to changes in credit spreads. Web spread duration is the sensitivity of a security’s price to changes in its credit spread. Web mario clarifies the difference between them. Web spread duration is a measure of the percentage change in a bond’s price for. Spread Duration Is.

From www.slideserve.com

PPT Duration times spread PowerPoint Presentation, free download ID Spread Duration Is Web spread duration is the sensitivity of a security’s price to changes in its credit spread. Web mario clarifies the difference between them. Web spread duration is a useful measure for determining a portfolio’s sensitivity to changes in credit spreads. One can easily prove that by using dts as the risk measure, we assume that credit spreads move in a. Spread Duration Is.

From transacted.io

Spread Duration Explained Transacted Spread Duration Is Web spread duration is the sensitivity of a security’s price to changes in its credit spread. One can easily prove that by using dts as the risk measure, we assume that credit spreads move in a relative fashion rather than a parallel fashion. Web spread duration is a measure of the percentage change in a bond’s price for a given. Spread Duration Is.

From www.nisa.com

Equity Spread Duration is Bubbling Up NISA Spread Duration Is Why not use another formula? Web why should one multiply duration and spread? One can easily prove that by using dts as the risk measure, we assume that credit spreads move in a relative fashion rather than a parallel fashion. Web spread duration is a measure of the percentage change in a bond’s price for a given change in its. Spread Duration Is.

From www.financestrategists.com

Spread Duration Definition, Components, & Applications Spread Duration Is One can easily prove that by using dts as the risk measure, we assume that credit spreads move in a relative fashion rather than a parallel fashion. Web spread duration is a measure of the percentage change in a bond’s price for a given change in its credit spread. A security’s credit spread is the. Why not use another formula?. Spread Duration Is.

From www.ejshin.org

Education Ultimate Fixed 101 What are Credit Spread, Spread Spread Duration Is One can easily prove that by using dts as the risk measure, we assume that credit spreads move in a relative fashion rather than a parallel fashion. Web why should one multiply duration and spread? Web spread duration is a measure of the percentage change in a bond’s price for a given change in its credit spread. Web mario clarifies. Spread Duration Is.

From www.slideserve.com

PPT Duration times spread PowerPoint Presentation, free download ID Spread Duration Is One can easily prove that by using dts as the risk measure, we assume that credit spreads move in a relative fashion rather than a parallel fashion. A security’s credit spread is the. Web mario clarifies the difference between them. Web spread duration is the sensitivity of a security’s price to changes in its credit spread. Web why should one. Spread Duration Is.

From www.slideserve.com

PPT Duration times spread PowerPoint Presentation, free download ID Spread Duration Is Why not use another formula? Web why should one multiply duration and spread? Web mario clarifies the difference between them. A security’s credit spread is the. Web spread duration is a measure of the percentage change in a bond’s price for a given change in its credit spread. One can easily prove that by using dts as the risk measure,. Spread Duration Is.

From www.investopedia.com

Duration and Convexity to Measure Bond Risk Spread Duration Is Web mario clarifies the difference between them. Web why should one multiply duration and spread? Web spread duration is the sensitivity of a security’s price to changes in its credit spread. A security’s credit spread is the. Web spread duration is a measure of the percentage change in a bond’s price for a given change in its credit spread. Web. Spread Duration Is.

From www.financestrategists.com

Spread Duration Definition, Components, & Applications Spread Duration Is Why not use another formula? One can easily prove that by using dts as the risk measure, we assume that credit spreads move in a relative fashion rather than a parallel fashion. A security’s credit spread is the. Web spread duration is a measure of the percentage change in a bond’s price for a given change in its credit spread.. Spread Duration Is.

From www.youtube.com

Understanding credit spread duration and its impact on bond prices Spread Duration Is Web spread duration is a useful measure for determining a portfolio’s sensitivity to changes in credit spreads. Web why should one multiply duration and spread? One can easily prove that by using dts as the risk measure, we assume that credit spreads move in a relative fashion rather than a parallel fashion. A security’s credit spread is the. Web spread. Spread Duration Is.

From www.financestrategists.com

Spread Duration Definition, Components, & Applications Spread Duration Is Web mario clarifies the difference between them. Web why should one multiply duration and spread? One can easily prove that by using dts as the risk measure, we assume that credit spreads move in a relative fashion rather than a parallel fashion. Web spread duration is a measure of the percentage change in a bond’s price for a given change. Spread Duration Is.